The Shortest Version

Stuart K. Hayashi

America’s billionaires are rich in their finances and poor in reputation. They have not been getting good press lately.

For much of the past few decades, the common attitude in America was that it is morally permissible to become a billionaire as long as one “gives back” in the form of philanthropy. But over the past several years, the debate has shifted to whether it should be legal for any entrepreneur to become a billionaire at all.

Heralding this change was a January 2019 interview that left-wing writer Ta-Nehisi Coates conducted with then-freshman U.S. Sen. Alexandria Ocasio-Cortez. “Do we live in a moral world [if it is one] that allows for billionaires?” Coates asked her. “Is that a moral outcome?”

“No, it is not,”

she replied. For this, she received uproarious cheers and applause. She went on, “I do think a system that allows billionaires to exist — when there are parts of Alabama where people are still getting ringworm because they don’t have access to public health — is wrong.” Here she insinuates that an entrepreneur possessing billions of dollars’ worth of wealth somehow

contributes to those Alabamans being too poor to receive adequate protection from, and treatment for, ringworm.

Sen. Ocasio-Cortez’s answer made headlines. It became apparent that many people in the United States and other countries agreed wholeheartedly with it. Almost as famously as his boss, AOC’s policy advisor and senior counsel Dan Riffle was

quoted throughout the media proclaiming, “Every billionaire is a policy failure.”

Still more notorious than AOC is a man with seniority over her in the U.S. Senate, Bernie Sanders of Vermont. “There is something profoundly wrong,” he

shouted in his announcement for his 2016 presidential run, “when in recent years, we have seen a proliferation of millionaires and billionaires [actually, ‘MILLIONAYAZ AND BILLIONAYAZ’] at the same time as millions of Americans are working longer hours for lower wages and we have shamefully the highest rate of childhood poverty of any major country.”

Note the implication here — as with Sen. Ocasio-Cortez — that the “lower wages” and “child poverty” are at least partially caused by this “proliferation of millionayaz and billionayaz.”

That billionaire entrepreneurs have an unflattering image can be seen even in attempts to compliment them. Such can be gleaned a video essay by pop-culture commentator Lindsay Ellis. Despite her

overall sympathies for

the anti-capitalist

message of the computer-animated movie adaptation of Dr. Seuss’s

The Lorax, she felt vicariously embarrassed that this moral was presented in such a ham-fisted manner. In a gesture of perfunctory evenhandedness, Ellis

states what she apparently considers to be the strongest argument in favor of for-profit commerce: “...corporations employ people and make us stuff — maybe not necessary stuff, but stuff.”

The triteness of her evaluation would not be so concerning, except that it is mostly the fault of capitalism’s defenders that Lindsay Ellis can issue it without any pushback. Something that most Americans fail to understand — as capitalism’s defenders have not spelled it out to them adequately — is that

capitalism saves lives. That is the reason why Ocasio-Cortez received endless accolades for

declaring in 2020 that billionaires “made that money off the backs of single mothers and all these people who are literally dying because they can’t afford to live.”

Human beings are “literally dying” for the reason that billionaires “made that money”? It is no wonder that the image of billionaires and capitalism has been tarnished.

Yet there is more to this story. Uğur Şahin and Özlem Türeci — the scientific married couple who cofounded BioNTech of Germany — became billionaires from developing the first existing COVID-19 vaccine. Louis Anslow, the curator of

The Pessimist’s Archive, noticed this and

tweeted out a

Time magazine cover featuring these two, asking in his tweet, “Are you sure

no one deserves to be a billionaire?”

Anslow’s is a worthwhile question. Let us examine it.

They Made a Billion By Saving Lives

This essay will feature a series of case studies of entrepreneurs profiting from the introduction of lifesaving innovations. The essay will then address the contention of AOC and Bernie Sanders that someone gaining a billion-dollar fortune invariably deprives the rest of the population, including the poorest section of it, of lifesaving resources it otherwise would have had. After all, goes that argument, even if someone becomes a billionaire by designing a lifesaving invention, that person holding a billion dollars will nonetheless contribute to shortening lives anyway and thereby undo much of the good done by that invention. The essay will then conclude with an examination of whether capitalism and the actions of entrepreneurs, cumulatively, ultimately save billions of human lives. We can begin with how entrepreneurs have taken on COVID.

Someone who did not become a billionaire, but became a multimillionaire, from

contributing to the COVID vaccine’s creation was Dr. Katalin Karikó. Fleeing from communist Hungary in 1980, she came to the USA with no more than $1,200 hidden in her daughter’s teddy bear. She became an academic scientist but, for over two decades at the University of Pennsylvania, her efforts to gain funding for research on mRNA vaccines were rebuffed. Other faculty members disrespected and even demoted her. Finally, she left UPenn for the position of vice president at BioNTech. There, at last she could apply her discoveries about mRNA to development of the COVID vaccine. For this, Dr. Karikó

has gained $3 million. In founding and managing BioNTech, Uğur Şahin and Özlem Türeci coordinated the efforts of Dr. Karikó and other scientists, and, through their organizational skills, managed all the resources and team members to put out the first vaccine for this pandemic.

Moderna came out with the second COVID vaccine, and thereby produced its own share of billionaires as well. Most of them were cofounders who invested their own money and thus acquired thousands of shares of ownership in it. Among them are Noubar Afeyan, Timothy Springer, and Robert Langer. Their ability to invest so much startup capital in Moderna was the result of prior valuable efforts in the health-care field.

Trained in chemical engineering, Afeyan coauthored numerous academic papers. He is named as an inventor or co-inventor on over 100 U.S. patents, most of which have had to do with the biomedical sciences. His experience in this area has given him insight on which firms will make for promising investments. Through his venture capital firm Flagship Pioneering, he became Modern’s principal shareholder.

So, too, was it the case of Timothy Springer and Bob Langer that, even before putting seed money into Moderna, they engaged in commercial ventures that improved health and human life.

In his early career as a researcher, Springer made important discoveries about integrins. As the

Wall Street Journal explains, “Integrins snare immune cells from the bloodstream and shuttle them to the site of an infection or injury. In autoimmune disorders, they traffic immune cells that attack the patient’s own tissue.” Springer spearheaded the commercial development of drugs to block the integrins that cause one such autoimmune disease, inflammatory bowel syndrome. He also guided the commercial development of drugs based on findings from colleagues who had partnered with him. Herman Waldmann discovered the antibody, alemtuzumab (CAMPATH-1). Springer

founded the firm LeukoSite to license Waldmann’s antibody to treat multiple sclerosis — often a cause of life-threatening complications — and leukemia.

Robert Langer made his first millions through an innovative approach to drug delivery. A recurring issue was figuring out how to administer the proper dose of a drug to the proper organ at the proper rate. To do this, Langer inserted the medicine into a capsule that would then be placed in the patient’s body. The capsule’s exterior was lined

with pores. As the capsule traveled through the patient’s body, the drug would be squeezed through the pores out of the capsule and into the patient’s system — at the rate that was appropriate. It was through this technique that Langer assisted Harvard researcher Judah Folkman in testing the efficacy of cancer drugs that have since hit the market.

Moderna’s president, Stephen Hoge, a medical doctor, became a billionaire as well from his ownership of shares in the company. He directly oversaw an important step in the vaccine’s development. Even with Dr. Karikó at BioNTech

licensing her mRNA technology to competitor Moderna, the latter company came across a difficulty. Its vaccine required a safe reproduction or facsimile of the COVID-19 virus’s spike protein so that the patient’s immune system could familiarize itself with the protein to form antibodies to attack it. The solution for Hoge’s team

was to employ a substitute, a spike protein from Middle Eastern Respiratory Syndrome virus that was similar enough to the COVID spike protein. Fortunately, the substitution worked, and immune systems of patients who receive COVID vaccines containing the MERS virus’s spike protein are able to recognize and guard against COVID’s.

Moderna’s salutary work in developing its own COVID vaccine made the company lots of money. Anticipating that they could cash in on that, would-be investors grew excited and bought shares in it. The increased demand drove up the stock price, thereby appreciating the value of the stakes held by Afeyan, Springer, Langer, and Hoge. And this was well-deserved. Afeyan, Springer, and Langer took the millions of dollars they had earned from their prior lifesaving work and plunked these sums down into Moderna at its inception. The cash went to procuring for Hoge and his team the equipment and other resources that went with running the experiments whereby they could develop their mRNA vaccine in competition with BioNTech’s.

A team led by Alison Galvani of the Yale School of Public Health revealed that from January to November 2021, COVID vaccines had

already saved 1.1 million lives in the United States. Likewise, data from 33 European countries evince that between December 2020 and November 2021, the vaccine saved a

total upward of 469,000 people in these countries who were already above the age of 60. BioNTech’s founding organizers and Moderna’s initial investors played roles in saving over 1 million lives and, in turn, each earned a billion dollars for it.

Someone getting rich by saving lives is far from unique to the COVID situation. I will provide several other examples.

Case Studies in Ventures Profiting From Saving Lives

In the 1990s, the National Cancer Institute funded the development of a worthwhile cancer drug called Taxol to be administered during chemotherapy. But for the cancer patient to receive Taxol, it had to be dissolved in a toxic chemical, Cremator El. For the patient to tolerate the toxin at all, she had to take other drugs, such as corticosteroid and antihistamines. Dr. Patrick Soon-Shiong, an immigrant to the United States from South Africa, sought to improve Taxol by creating a version that did not have to be dissolved in a toxin. His method was to wrap the drug in an “envelope” of albumin, a protein already found in blood plasma. Through this method, Dr. Soon-Shiong was able to deliver the lifesaving medicine while reducing the nausea and discomfort. He gave this new version the brand name of “Abraxane.” And there turned out to be an added benefit: Abraxane ended up outperforming conventional Taxol in the saving of lives.

Abraxane, Hwaryeon Lee and company

report in the journal

Nature, turned out to be “more effective” than conventional Taxol in the treatment of metastatic breast cancer. In trials, Abraxane outshone the original Taxol in the rate at which the metastatic breast cancer could be controlled and in terms of the patient’s ability to survive without the cancer progressing. William J. Gradishar and colleagues

found in 2006 that metastatic breast cancer patients who received Abraxane even had almost double the overall response rate than did those receiving the conventional Taxol. For this lifesaving, Soon-Shiong gained a

net worth of $9.5 billion. And that is not all.

Another important cancer treatment is trastuzumab — brand name Herceptin — a drug that Axel Ullrich co-developed through genetic engineering at Genentech, Inc., in the 1980s. Ten years after having receiving Herceptin, breast cancer patients have had a disease-free survival rate

ranging from 70 to 75 percent. Seventy percent of the

2.7 million women treated with it would be 1.89 million lives saved. Axel Ullrich has helped save 1.89 million lives. And from that, he has

earned over $10 million.

Since Ullrich’s time, genetic engineering has been exploited for even more thrilling efforts. Jennifer Doudna co-developed CRISPR. There are viruses that eat bacteria, and the bacteria defend themselves against such viruses by employing the chemical protein Cas9. It slices up the virus. Dr. Doudna’s co-discovery was that this same Cas9 can be exploited to splice and recombine human genes. Hence, this technique, known as CRISPR, can remove from the human genome the DNA sequences that cause such hereditary diseases as cystic fibrosis and sickle-cell anemia. With this technology, she co-founded the company Caribou Biosciences, which has a 21.9 percent stake in yet another company, Intellia Therapeutics. Intellia is already saving lives in collaboration with another biotech firm, Regeneron. Patrick Doherty inherited a rare degenerative nerve disease called transthyretin amyloidosis. Under this condition, a protein in the body destroys the nerves in the hands and feet of sufferers, crippling and ultimately killing them. In an experiment funded by both Regeneron and Intellia, Doherty and five other patients had their genomes altered by means of a CRISPR technique that Regeneron and Intellia have refined.

This procedure was one of doctors inserting billions of nanoparticles into the patients, each nanoparticle designed to trigger the CRISPR gene-editor. Once the nanoparticles entered the patient’s liver, the nanoparticles activated the gene-editor. Cas9 sliced apart the DNA inside the liver that was producing the destructive protein. The patients have

thus shown significant improvement.

Doudna and Regeneron take this as empirical evidence that CRISPR can indeed be employed to mitigate much-more-common genetic disorders. On account of this promise, as with Moderna, demand has soared for stock in Caribou Biosciences, Intellia, and Regeneron. Doudna’s

stake in Caribou Biosciences has given her $24 million. Because of this and other projects of his at Regeneron, George Yancopoulos has become the first corporate research-and-development chief

to become a billionaire.

Vaccines more traditional than Moderna’s have also saved lives profitably. Paul Offit, Stanley Plotkin, and Fred Clark co-invented RotaTeq, a rotavirus vaccine

credited with saving 1.46 million lives every two years. For that, each of those three

received $6 million from Merck.

David Hamilton Smith co-invented a vaccine for

Haemophilus influenzaea Type B, a pathogen that causes meningitis. Because no pharmaceutical firms were interested in purchasing the rights to his vaccine, Smith had to start his own, Praxis Biologics, to manufacture it himself. ScienceHeroesDotCom

estimates that this vaccine has preserved 5 million lives. Smith eventually sold Praxis

for $232 million.

In his barn in the 1950s, Wilson Greatbatch invented the first implantable pacemaker,

applauded for saving 22.5 million lives from heart block. For this, he

accrued over $10 million. As the

New York Times put it, “Mr. Greatbatch profited handsomely from his invention and invested” in refining it to making models that were even safer. Subsequent to the success of his first pacemaker model, Greatbatch wanted to contrive a more reliable means of powering the device. That came in the form of a lithium-iodide battery, which he began installing in his pacemakers in 1972.

Paving the way for Greatbatch in the 1950s were engineer Earl Bakken and cardiac surgeon C. Walton Lillehei. Bakken invented the first pacemaker that had to be worn outside the patient’s body, and he founded the now-giant Medtronic corporation to market it. Lillehei consulted the companies Medtronic, Cardiac Pacemaker, and St. Jude Medical in their development of medical devices for heart patients. For this, he was paid in stock. These developments resulted in making both

Bakken and

Lillehei multimillionaires as well.

Working in a similar vein was Austrian-born Kurt Amplatz, yet another doctor. An added major heart problem was atrial septal defect in infants. The atria — the upper chambers of the heart — are supposed to be divided by a septum that closes. When the septum cannot close, the baby’s life is in a precarious state. To mitigate this risk and separate the atria artificially, Amplatz invented Amplatzer Septal Occluder and Amplatzer Cribriform Occluder. In 1958, he was able to insert these devices into an infant. As he was able to do this using a catheter, open-heart surgery was not required. To sell this medical device, he cofounded the company AGA Medical and earned over 100 U.S. patents. In 2010, the same St. Jude Medical that Lillehei consulted had purchased AGA Medical for $1 billion. The extent of the wealth that Amplatz amassed can be discerned by how, in 2009, his daughter

turned over $50 million to the University of Minnesota Children’s Hospital.

Someone who innovated both medicine and safety devices was Percy Julian, Sr., born in Montgomery, Alabama, in 1899, the grandson of slaves. In spite of the heavy discrimination, he became director of research at the Glidden Company where he extracted chemicals from soy and synthesized them into new compounds. First at Glidden and then at his own firm Julian Laboratories, which he started in 1953, he produced steroids to treat the sufferers of rheumatoid arthritis. But Julian’s work did not merely relieve pain; it also cut down the number of fatalities. In the early 1940s, he made improvements on the substances contained in fire extinguishers. As

recounted on the website of the PBS series

Nova, at Glidden he “extracted a soy protein used in fire-fighting foam, which saved thousands of lives during World War II.” In 1961 he sold Julian Laboratories for $2.3 million — $20 million in 2022 U.S. dollars. Much of the proceeds he would donate to the civil rights movement.

Concerned about the victims of house fires, in 1972 engineer-entrepreneur Duane Pearsall began selling the first practical smoke detector. Just as sales were picking up in 1976, Ralph Nader and his group Public Citizen

launched a campaign against this device, blaring that it was dangerously radioactive and would give cancer to every household resident. Public Citizen therefore

demanded the Nuclear Regulatory Commission ban this product and institute a nationwide recall. Fortunately, the NRC refused, and more households adopted the invention. Due in part to this, the rate of house-fire fatalities in the USA declined from 57 in a million people

in 1972 to fewer than 12 in a million

by 2009. In 2004, the Worcester Polytechnic Institute

presented Pearsall an award for “saving upwards of 50,000 lives from deadly residential fires over the past 30 years.”

Among the global population that doesn’t have electricity,

4.1 percent die annually from this absence. Specifically, people in less-developed regions keep warm at night by putting wood or even dung in their fireplaces. They inhale the fumes and it damages their lungs. This is

known as indoor air pollution. Thankfully, 6.873 billion members of the global population

do have electricity. With this power, they heat their homes much more safely. Had these people had no access to this energy, and 4.1 percent of them died from this, that would be 123 million people. Hence, the innovators who set up the first electric generation systems, George Westinghouse and Thomas Edison, thereby saved that many lives from indoor air pollution. Respectively, they earned

$50 million and

$12 million. In 2021 U.S. dollars,

that is $1.2 billion and $213 million. By today’s standards, lifesaving made Westinghouse a billionaire and put Edison one-fifth on his way to being one.

When people hear about “lasers,” they usually think of weapons from science-fiction stories. But lasers were

instrumental in mapping people’s genetic sequences. This mapping helps detect people’s susceptibility to particular heritable illnesses, and the World Economic Forum

lauds this laser-based mapping for saving 5 million lives per year. Gordon Gould

gained $46 million from co-inventing the laser. His work helped make that a reality.

At the turn of the twentieth century, the British scientist Sir William Crookes warned darkly that the agricultural practices of the day had depleted nutrients from the soil and rendering it unable to sustain future farming. He forecast famines in the West. Taking that to heart was Fritz Haber in Germany when he devised a method for synthesizing ammonium nitrate fertilizer. Corporate executive Carl Bosch, a fellow German and chemical engineer, refined the mechanisms whereby this fertilizer would be produced on an industrial scale. This prevented the famines that Sir William predicted.

According to ScienceHeroes.Com, Bosch and Haber saved 2.3 billion lives. In a

Wired article from 2013, Bill Gates

informed his readers, “Two out of every five people on Earth today owe their lives to the higher crop outputs” that the Haber-Bosch process “has made possible.” By the evaluation of ScienceHeroesDotCom, this makes Haber and Bosch the two biggest lifesavers among scientists. Despite the creator of ScienceHeroes.Com regularly

expressing his unflattering opinions of capitalism, the scientific project that has saved more lives than any other was a for-profit commercial venture.

Does Someone Having a Billion-Dollar Fortune Deprive the Rest of the Population of a Billion Dollars’ Worth of Resources?

Yet those who look askance upon capitalism and billionaires are probably not satisfied. The frequent reply is, “Yes, that entrepreneurs produce medical devices is nice. But as the Earth consists of a fixed quantity of nonrenewable natural resources, it follows that one person owning a billion dollars’ worth of resources means there is less for everyone else. Even if his invention of Abraxane saved many lives, Patrick Soon-Shiong having seven billion dollars contributes to the globe’s poorest people lacking in the seven billion dollars’ worth of lifesaving resources that they need and otherwise might have had.”

Hence Alexandria Ocasio-Cortez

pronounces, “No one ever

makes a billion dollars. You

take a billion dollars.” (emphases hers). And she

continues that “this system that we live in — life in capitalism — always ends in billionaires. This thing that we live in, starves people.”

To wit, the richer a billionaire is, the more it “starves people.”

That capitalism staves people is an odd claim to the employees of agribusinesses. It would have been news to Carl Bosch.

Yet Dan Riffle, the policy advisor and senior counsel to AOC, reinforces his employer’s zero-sum interpretation. After pretending to understand that more economic value can be created, Riffle makes it known that he will continue to deny, arbitrarily, the logical ramifications of such a fact. That is implicit in his

proclamation that “it’s certainly the case that the bigger Jeff Bezos’s and Bill Gates’s slices of the pie are, the smaller everybody else’s slices of the pie are going to be.”

This is the same idea behind Bernie Sanders’s notorious

assertion, “You don’t necessarily need a choice of 23 underarm spray deodorants or of 18 different pairs of sneakers when children are hungry in this country.” Bernie’s presumption is that the resources that went into producing the twenty-three different types of deodorant and eighteen models of athletic shoes were resources that otherwise would have gone into feeding kids starving in the USA. The number of choices in hygiene canisters and fancy footwear is inversely proportional to the ability of America’s youngsters to have enough to eat.

The belief has been

expressed by Percy Bysshe Shelley in words that would become cliché soon after they were published: “The rich have become richer, and the poor have become poorer...”

That slogan’s enduring popularity derives from a flagrant misunderstanding of the nature of wealth. The wealth that distinguishes a grand living standard from an inadequate one has less to do with monetary units than with the goods and services for which those monetary units are exchanged. More than that, that wealth is not an inherent function of the quantity of nonrenewable natural resources available. Instead, wealth is in the efficiency of the methods employed to derive life-enhancing value from such resources.

Alexandria Ocasio-Cortez

blares, “Usually if you’re a billionaire, it means that you control a massive system. It means that you own oil supplies.”

She talks as if petroleum was always inherently desirable and worth being in everyone’s control collectively. In so doing, she omits that these oil supplies would not have been valuable if not for entrepreneurs’ initiative. The default was that for most of human history, having access to a gallon’s worth of crude oil was not of advantage to anyone. From the Middle Ages to the eighteenth century, farmers hated it when they found the black sludge. The foul-smelling goop seeped and damaged their crops. The presence of oil on their land invariably reduced marketplace demand for the property. Striking oil only became a plus and not a minus in the nineteenth century when Canadian geologist, chemist, and entrepreneur Abraham Gesner discovered and publicized the properties of petroleum that made it ideal as a source of fuel. Gesner had demonstrated that this petroleum rivaled the utility of the oil that, at the time, hunters extracted from a dwindling number of whales.

That is, a gallon’s worth of crude was not what everyone always wanted. It became desirable subsequent to Gesner putting in the effort to discover its usefulness and such entrepreneurs as George Bissell and John D. Rockefeller, Sr., building up the infrastructure whereby petroleum’s usefulness could be applied most effectively.

It was not obvious to the ancient humans who first encountered petrified tree sap that one day it could be placed in telegraphs to have them transmit electrical signals. Nor was it obvious to the first caravans that the sand over which they traveled could be converted into cables that, in the future, would enable one person to communicate instantaneously to someone else on the other side of the planet. And it was not obvious to the humans who first observed lithium that such a metal would be an excellent conductor in tiny rechargeable batteries powering telephones and computers fitting in their pockets. Nor was it obvious that such a metal would be invaluable to keeping hearts pumping, as do the lithium-iodide batteries in Wilson Greatbatch’s implantable pacemakers.

The extension or improvement of life that someone gets out of a good or service is what can be called “economic value.” That is wealth in its most direct form. And this economic value is not fixed and intrinsic to units of natural resources. It is instead to be found in human methods for making use of those resources.

The economic value that a business produces for its customers is called “output.” “Inputs” refer to the resources that must be used up in the process of generating the output. Inputs include both human labor and the natural resources that the operation entails.

To the extent that people are free and their private property rights are enforced, every input in an entrepreneur’s operations imposes a cost upon that entrepreneur. Thus, the entrepreneur downsizes her costs, and thereby upsizes her profits, insofar as she employs new techniques for producing at least as much economic value as she did before from ever-smaller and ever-fewer inputs of labor and natural resources.

↑ Profit = Economic value to customers (Revenue from sale) – ↓ Cost of natural-resource inputs

That involves the development of technologies that improve efficiency.

A

case study of this is in the evolution of electric dynamos. The power plant that Thomas Edison finished constructing in 1882 on Pearl Street in Menlo Park, New Jersey, had six Jumbo dynamos. Each of these dynamos weighed 54,000 pounds and generated 100,000 watts. That is 1.85 watts of electricity generated per pound of machinery. By contrast, a gasoline-powered 10,000-watt dynamo constructed by the firm Briggs and Stratton in 2021 generates 34.7 watts per pound.

Edison’s total investment in the Pearl Street power plant was $600,000. In 2021, U.S. dollars, that comes to $16.84 million. Hence, the cost to Edison was, in 2021 U.S. dollars, $28.08 per watt generated. In 2021, an entrepreneur could buy sixty 10,000-watt Briggs and Stratton generators, each for $2,000. For that entrepreneur in 2021, generating a single watt of electricity would cost 20 cents.

Due to efficiency improvements, a single pound’s worth of material comprising a dynamo in the year 2021 could generate more than eighteen times as many watts as Edison’s dynamos, and at less than one percent of the cost.

And that is far from all. Consider the nonrenewable natural resource that is coal. Every few years during the early twentieth century, engineers introduced another model of coal-burning machinery that

exerted greater thermal efficiency than did the older models. In the year 1900, more than seven pounds of coal had to be burned to power a 100-watt lightbulb for one hour. By the year 2000, for that same lightbulb to perform that same task required burning less than a single pound.

That principle can be expressed through other figures. Lumens are the units by which light is measured. In the year 1898, one watt powering an incandescent lightbulb would produce six lumens. In 1920, that watt produced ten lumens. In 2003,

it would be 200 lumens. That is less and less coal burned to produce a single lumen.

Recall the point from earlier about Edison’s dynamos. In 1898, a single pound’s worth of Edison’s dynamo would generate 11.16 lumens. By 2003, a single pound’s worth of a Briggs and Stratton dynamo could supply 6,940 lumens. In a little over a century, then, the number of lumens generated by that single pound of material had grown over 600-fold.

Indeed, steel has been used more efficiently over the course of the century. That is one reason why the weight of automobiles

dropped by one fourth between the years 1970 and 2001. For such reasons, between the years 2000 and 2015, even as there was an increase in the quantity of products containing steel, total use of the alloy in the United States

fell by 15 percent.

Steel is set to work more efficiently than before and, in turn, it is produced more efficiently as well. Forging steel has always required that iron be heated to the extent that it takes on a molten form. At the opening of the nineteenth century, producers had to burn an average seven tons of coal to churn out a single ton of “blister” steel. This changed in 1856 with inventor-entrepreneur Henry Bessemer introducing the process named for him, wherein cold air would be blasted upon the super-heated iron. Then it

took no more than 2.5 tons of coal, in super-heated “coke” form, to finalize a ton of higher-quality “crucible” steel. By the year 2020, putting out that same ton of steel

required less than 0.86 tons of coal.

And coal is not the only resource being inputted more economically in steelmaking. Between the years 1930 and 1949, making a single ton of steel cost an average 200 tons of water. That figure decreased to 20 tons by the 1980s. By 2018, the most efficient plants

could make a ton of steel from three to four tons.

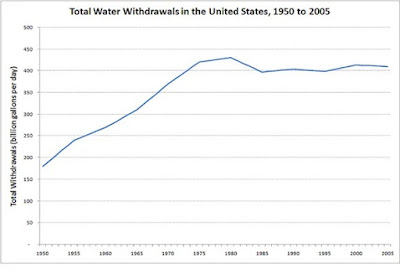

For most of the USA’s history, the total quantity of water used daily steadily increased. But that peaked around the year 1975 at 425 billion gallons per day. From then on, the quantity of water Americans washed down daily remained relatively stable, even as the population and industrial output both grew. From 1984 to 2004, the USA’s per-capita water usage actually

dipped by twenty percent.

In the year 1975, every cubic meter of water inputted for industrial purposes yielded, in 2021 U.S. dollars, an average eleven dollars in utility. By 1999, also in 2021 U.S. dollars,

that figure doubled.

The automobile engines of 2002 were

twice as powerful as were those from thirty years earlier. Yet they emitted half as much in exhaust fumes.

Other modes of transportation undergo the same evolution.

Compared to one from 1970, a Boeing 747 commercial airliner in 2002 was half as loud and consumed 17 percent less fuel even as it worked at a quarter more horsepower at takeoff. In the duration of 1960 to 1990, the thrust-to-weight ratio in commercial jet engines

increased from 4.2 to six. Similarly, between 1940 and 2000, the thrust-to-weight ratio of the gas turbines in these same airplanes

lifted from 15 percent to more than 40 percent.

Throughout the 1950s and 1970s, a computer would take up the size of an entire room or even an entire building. Here, inventor-engineer-entrepreneur Ray Kurzweil makes an impressive comparison.

He says that in the 1970s, considering the state of technology at the time, it would have taken trillions of U.S. dollars’ worth of resources to assemble a computer with the same amount of computing power as those of the smartphones that African villagers were carrying around in 2013.

Speaking of mobile phones, from 1990 to 2011, the average weight of one

shrank from twenty-one ounces to four ounces. That is, a mobile phone from 2011 was five times lighter than one from two decades prior. Much of this trend has to do with

improvements in the efficiency of lithium-ion batteries inside these mobile devices. Between 2008 and 2015, the quantity of kilowatt hours generated per liter of lithium-ion doubled from 200 to 400. And between 2010 and 2017, the quantity of watt hours per kilogram of lithium-ion

almost tripled from a little over 100 to 300. Stated in other terms, a mobile phone manufactured in 2015 could perform the same tasks as one from 2008 on just half the amount of lithium.

Using weight as a proxy in measuring mass, we can discern that a particular product today can deliver the same quantity of output as that product’s counterpart from decades ago even though the product of today uses up a smaller quantity of mass from natural resources.

This likewise happens with household tools. The first power drills came out in Germany in 1895. Each weighed seventeen pounds and was only slightly more powerful than a hand-cranked drill. To operate it, a worker had to grab its two handles and hold it up to his chest. The on-off switch was far away from the machine. To turn it off, the operator had to take his hand off the tool itself. That way, the operator could lose control of the machine and injure himself. In 1917, the American inventors Samuel Duncan Black and Alonzo G. Decker, Sr., introduced a variant

that was eight pounds — less than half that of its predecessor — and was easier to use. It had a trigger like a gun that, when pulled, turned the drill on. Black and Decker priced it at $230, which is over $5,000 in 2021 U.S. dollars.

By 1921, Arno H. Petersen

made a version that was still more ergonomic. Instead of putting the trigger where it would go on a gun, Petersen put it on a handle behind the motor. This put less stress on the forearm of the person operating it. And it was four pounds, and sold each unit at $42. That is $638.07 in 2021 U.S. dollars. Petersen’s version, christened the “Hole Shooter,” serves as the general model for those being manufactured in 2022, being roughly the same weight and largely the same in design. In short, the power drills at the time of this writing give us greater output than those from 1895 but are less than a quarter of their weight and sell for less than one percent of their real price.

In 2001, science journalist Ronald Bailey listed

other examples of consumers receiving the same or greater economic value from products that consisted of less mass, overall, than did their counterparts from prior decades. That year, food cans were half the weight of those from 1951. Concordantly, plastic soda bottles were only seventy percent the weight of those being sold in the 1970s, and the ones from the 1970s were already lighter than the glass bottles they replaced.

We can dispel any notion that the reduction in the quantity of one category of natural-resource inputs in every unit produced simply shifts to an increased use of a different natural-resource input for that unit. We can do so by examining how much energy altogether is expended on creating an average unit of economic value. This can be done by looking at overall energy intensity. This is how much energy in total — coal, oil, nuclear, and renewables combined — go into the production of economic value. Energy intensity measures the quantity of megajoules that had to be generated to produce an average inflation-adjusted dollar’s worth of economic value. A reduction in the energy-intensity ratio over time means that smaller and smaller quantities of natural resources must be converted into energy to yield the same quantity of economic value.

And that is

what we find. From 1880 to 2000, the number of megajoules that had to be generated in the USA to bring forth a constant 1990 U.S. dollar’s worth of economic value shrank from 50 to 15. For the United Kingdom in the year 1830, 35 megajoules had to be generated to produce a constant 1990 U.S. dollar’s worth of value. By the year 2000, it was 15.

It may be said that even if a specific unit of a good has shrunk in mass, such as computers getting smaller, the total quantity of natural resources consumed annually has expanded on account of the number of units produced growing annually as well. But, no, the improvements in efficiency have even preempted a major increase in the total quantity of natural resources consumed per year.

Economists calculate the weight of all the goods and services circulating through the U.S. economy. Once again, we use the weight of objects as a proxy in measuring their mass. Alan Greenspan notes that since 1977, the estimated real goods output of the United States annually has maintained a relatively stable weight.

It reached high points of 1.2 billion metric tons in the separate years of 1979 and 2013.

Rockefeller University scholar Jesse Ausubel

writes that among 100 commodities studied by Paul Waggoner, Iddo Wernick, and himself, the total annual usage of 36 of them — including steel, timber, paper, asbestos, and chromium — peaked in 1970 and then dropped off since then.

All this happened even as the American economy experienced a net growth since 1979. The increase in wealth is due not to a net increase in the total consumption of natural resources as much as how smartly those natural resources are being utilized.

Although more quantities of land cannot be created, technological improvements have even allowed the same square acre of land to support more human beings. This happened with the invention of the skyscraper in the nineteenth century. As

noted by London’s Economic Development Office, “Accommodating the same number of people in a tall building of 50 stories as in a large building of five stories requires roughly one tenth of the land.” Many great technologies have also enabled farmers to grow more food per acre of earth. From 1950 to 2001, corn yields per acre in the United States

tripled.

How Entrepreneurs’ Actions, in Total, Save Billions of Lives

Those profit-driven efficiency gains add up to raising living standards and, in the end, saving lives. Although the U.S. Treasury and Federal Reserve System have devalued the currency over the past century, and, with it, the purchasing power of Americans’ savings, there is an important respect in which entrepreneurs’ efficiency improvements have continually made many consumer goods cheaper. That would be the average amount of time someone has to spend at work to acquire such a good. In 1900, affording 100 kilowatt hours of electricity would entail working for 107 hours and 17 minutes. By 1990, that quantity could be earned by spending 43 minutes at work.

The same trend is seen with food, and it cannot be attributed properly to federal legislation such as the Fair Labor Standards Act of 1938. The cost and price of chicken were already falling before that law’s passage. Between 1900 and 1930, the number of hours one had to labor to obtain this three-pound chicken fell from 160 to 110.

Citing a

2004 study by Erik Rauch at MIT, utilizing U.S. Bureau of Labor Statistics

data from 1947 to 2000, Silicon Valley tech writer Andy Kessler

observes that by the year 2000, someone would only need to work eleven hours a week to receive the equivalent of what a full forty-hour work week provided someone in 1950. To put it into perspective, Kessler writes that “we could have knocked 30 minutes off the average work week every year since 1950” and by the year 2000, “still maintained our 1950 standard of living.”

And, indeed, even as lithium is employed more efficiently in machines, its real price keeps falling. Between 2010 and 2019, its price per kilowatt hour in 2021 U.S. dollars

descended from $1,253 to $166. In nine years, that was a more-than-fivefold decrease.

For many consumer goods, a single hour of work will buy someone in the First World a greater quantity of these consumer goods than that same work would have fetched for any previous generation. That is a net gain in wealth for everyone in the First World.

In the United States, a household falling under a certain income threshold puts it under the official federal poverty line. Whether the household is in poverty is

calculated by the U.S. Department of Health and Human Services according to the household’s income and the number of people living in it. As of this writing, a family of four is under the poverty line if it brings in less than $26,500 annually. Even many households under this poverty line provide evidence of how living standards improve to the extent that people are free. In 1950, fewer than 80 percent of all U.S. households possessed a refrigerator. By 1997, a refrigerator was in 90 percent of U.S. households falling under the federal poverty line.

To be sure, there are some vital goods and services that over the past fifty years have only gotten more expensive, even after adjusting for inflation. Those goods and services include real estate, health care, and university education. However, this has to do with taxpayer subsidies that assist people in procuring these goods and services. Those taxpayer subsidies drive up demand and, in turn, the parties that sell these goods and services respond to the uptick in demand

by raising their real prices. When it comes to goods and services whose purchases are not taxpayer-subsidized among the general population, such as mobile phones, the trend is still that improvements in the efficiency of production lower the real price.

Yet most of the world’s human population persists in being poorer than it should be. As discussed earlier, there are still many casualties from people breathing — as they try to keep warm — the fumes rising from their fireplaces. The

main reason for the holdup in development is that most countries have kleptocratic governments. Often on a whim, the State itself will seize the people’s meager belongings. But to the extent that they have experienced any liberalization, such as the countries becoming more open to international trade and direct investment, the perks of liberalization have conferred improvements in living standards upon the developing world’s residents as well.

Consequently, average living standards have climbed in both the rich countries and the developing ones over the past half-century. The economists David Dollar and Aart Kraay

discovered, “When average income rises, the average incomes of the poorest fifth of society rise proportionately.” A trio of academic economists led by John Luke Gallup had a corroboratory result. They

discerned “a strong relationship between overall income growth and real growth of the income of the poor.”

We can gain insight into these changes by observing what the United Nations

defines as life-threatening absolute poverty. Someone falls under that threshold if that person makes less than $1.90 per day in inflation-adjusted 2021 U.S. dollars. Someone can fall under the USA’s federal poverty line but still be out of absolute poverty by the U.N.’s standard.

Overall, the rate of life-threatening absolute poverty has been slashed, even in the developing countries. Between 1981 and 2008, the share of the global human population in life-threatening poverty

dropped from 52 percent to 22 percent. That is a figure sliced by more than half.

China’s ascension to wealth is not sufficient to explain this decline. Professor Max Roser of

Our World in Data looked at what the results were when China was excluded. In 1981, 29 percent of the non-Chinese human population was in absolute poverty,

whereas in 2013 the figure was 12 percent.

Many readers are tempted to attribute this poverty reduction chiefly to taxpayer-funded foreign aid and to charitable NGOs. Columbia University’s Howard Steven Friedman inquired into how much, between the years 2000 and 2013, the taxpayer-funded U.N. Millennium Development Goals (MDG) had to do with the developing countries’ progress. It

turns out the MDG had very little to do with the improvements; it was mostly for-profit commerce and private charity.

The World Bank does not attribute trade as the prime reason for the poverty reduction, but the trade does contribute to what the World Bank determines is the prime reason. As the World Bank

explains, “the creation of millions of new, more productive jobs, mostly in Asia, but also in other parts of the developing world, has been the main driving force...” After all, “the private sector is the main engine of job creation and the source of almost 9 of every 10 jobs in the world.”

Among those jobs are those that capitalism’s detractors have reviled as exploitation. These would be initially low-paying jobs in factories established through foreign direct investment, factories often impugned as “sweatshops.” From the 1950s onward, Asians opted for these sweatshops in cities because they paid two to three times as much as those in the village or countryside. Contrary to modern assumptions, in countries that are more politically liberalized we notice that the trend is not for the majority of the workforce to be stuck in low-paying drudgery for decades on end.

Reason magazine has

profiled a factory in Taiwan that, during the 1970s, manufactured Barbie dolls. The workers in such factories saved their money and sent their children to schools to hone other skills. That is how countries such as Japan and Taiwan arose from destitution to First-World affluence. A similar phenomenon took off in India in the early 1990s with its deregulation of information technology.

The World Bank’s 2013 findings on poverty reduction corroborate Ayn Rand’s observations from over three decades earlier. She already

noted that insofar as it has been implemented, capitalism has “raised the standard of living of its poorest citizens to heights no collectivist system has ever begun to equal, and no tribal gang can conceive of.” For such reasons, Rand

related elsewhere, “If capitalism had never existed, any honest humanitarian should have been struggling to invent it.”

We often hear that capitalism must be fought by antipoverty programs. Yet capitalism is the antipoverty program.

That cliché that Percy Bysshe Shelley popularized about the rich causing the poor to become poorer is economically illiterate. To the extent that people are free to enterprise, the rich get richer and the poor get richer.

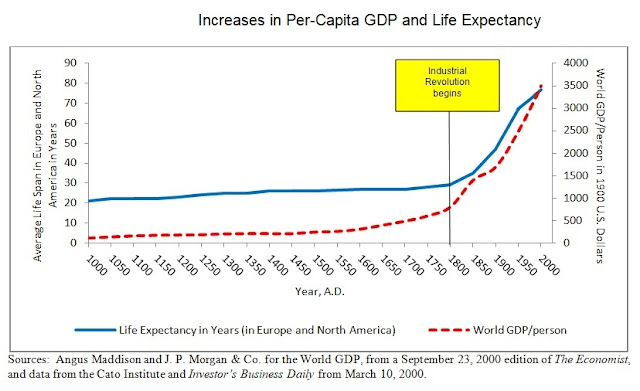

From the relative liberalization in the nineteenth century, and as a result of its consequent Industrial Revolution, the average lifespan in the United Kingdom, Western Europe, and North America ascended from 27 years in 1800 to 77 years by 1988. Starting in the late twentieth century, the developing countries began to experience comparable effects to the extent that they have been exposed to the effects of liberalization.

Georgetown University economist Steven Radelet points out that between 1980 and 2015, “the rate of child death has declined in every single developing country in the world where data are available.

There are no exceptions” (emphasis Radelet’s).

But as Max Roser points out at

Our World in Data, the overall boost in average lifespan is

due not only to reductions in the infant mortality rate. Up to the seventies, the mortality rate has decreased among every ten-year age bracket.

Conclusion

Contrary to the assumptions of Alexandria Ocasio-Cortez and her counsel Dan Riffle, someone such as Patrick Soon-Shiong acquiring a billion dollars’ worth of monetary exchange value does not deprive the rest of the human population of a total billion dollars’ worth of resources. That entrepreneur’s billion is the consequence of that entrepreneur obtaining natural resources and, by exercising a technique to boost efficiency, altering those natural resources in such a manner that they now provide a greater benefit to human beings than they did in their previous state. The billionaire’s profit is equal to the new value that the billionaire’s efforts produced from the resources inputted, a net increase in the value of the resources employed.

Consider a gram of lithium. Starting in the middle of the nineteenth century, it was occasionally imbibed as a form of medication. For the most part, though, it was exotic. It would not have provided much value to the average person living in the year 1870 or even 1930. Once converted into a particular form, however, that same gram of lithium proved to be of much more practical and immediate value to someone in the year 2009. This is on account of electronics tycoons such as Craig McCaw, Philippe Kahn, and Steve Jobs having lithium power their mobile phones and of medical-device innovators such as Wilson Greatbatch exploiting it to enhance his pacemakers. That usefulness — that value — added to the lithium is economic value that such entrepreneurs created, and for which they are paid in kind.

If someone acquires a billion dollars through the sale of goods or services, it is because his planning and organizing skills had created, for the world, a net increase in economic value of such magnitude that his customers willingly paid him a total one billion dollars for it. And those customers made such deals because what that entrepreneur provided them was of greater value to them than the money they paid him. The principle remains the same if an entrepreneur becomes a billionaire on account of a jump in the price of corporate shares he owns. In that case, the entrepreneur earns those would-be investors’ confidence that his company will profit its owners by providing great value to customers in the future. Anticipating that the entrepreneur will persist in exercising such competence, demand for ownership in the entrepreneur’s company increases among investors. The more eager the investors are to grab a piece of the action, the greater the demand is for shares in the entrepreneur’s company. Capitalism is win-win.

Technological innovation is something that has, on a net balance, saved lives demonstrably. This principle applies not merely to specific industries or instances, such as with Axel Ullrich’s cancer drug. This is what happens

in total. We see this when we recognize that poverty has always been the default for human beings since the Stone Age. The living standards that exist beyond that are the result of technological innovation. Examining females in the Hiwi hunter-gatherer band who reach the age of fifteen,

only a quarter will live to 70. By contrast, with fifteen-year-olds in a modern industrial society,

three quarters can expect to be around for their seventieth birthday. In members of the Arikara hunter-gatherer clan found in mass burial sites, the mortality rate for those aged 20 to 40

was 15.3 percent. In American citizens today in that same age range, we have a mortality rate of 3.7 percent. The larger survival rate is the result of technological progress.

And the main cause of this technological innovation has been for-profit commerce. As sometimes admitted in reports by the

OECD and

U.S. Bureau of Labor Statistics, more innovation comes from private research-and-development than taxpayer funding. And as admitted by Swedish researchers, it is for-profit ventures and not socialist State-owned enterprises that introduce new inventions. Ove Granstrand and Sverker Alänge

partook in a study of their native Sweden, examining the origins of the country’s hundred “most economically important innovations” to emerge in the duration of 1945 to 1980. That period was when Sweden was truly democratically socialist as its heavy industry, such as steelmaking and automobile manufacture, were organized in State-owned monopolies, prior to these State-owned enterprises being privatized throughout the ‘80s and ‘90s. In the duration of socialism, eighty percent of technological innovations within Sweden originated from its major private, for-profit corporations. Twenty percent arrived from then-small startup firms. By contrast, innovation from the country’s socialized State-owned enterprises was “marginal,” . . . meaning zero.

Capitalism rescues us from the high mortality rates that hunter-gatherers experience, and which we would continue to experience if not for the Industrial Revolution and its consequent technological developments.

This is what someone should have informed Lindsay Ellis in her video about capitalism. It is a point that also needs to be made clear in rebuttal to Alexandria Ocasio-Cortez and Bernie Sanders. Billionaires and capitalism do provide us “stuff,” yes, but there is a much grander result than that. To the extent that the relative freedom of a liberal republic has been of benefit to you, billionaires and capitalism save both your life and mine every day.